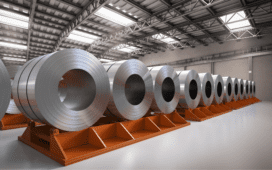

The European Union’s Carbon Border Adjustment Mechanism (CBAM) — the world’s first carbon tax on imported goods — came into effect on January 1, 2026, placing additional charges on carbon-intensive products such as steel and aluminium entering the bloc. The policy aims to level the playing field between EU producers and foreign exporters while incentivising cleaner production methods. However, the move has drawn criticism from developing countries, including India, which argue that CBAM may conflict with established international environmental principles.

Trade analysts warn that Indian steel and aluminium exporters could be forced to reduce prices by as much as 15–22% to offset the added carbon costs borne by EU importers, potentially eroding competitiveness. Smaller firms may face disproportionate challenges due to higher compliance and reporting burdens. As CBAM enters its payment phase, concerns are mounting that India’s metal exports to the EU could face sustained pricing pressure unless emissions reporting improves and trade negotiations with the EU yield mitigating measures.

Reference: Read more