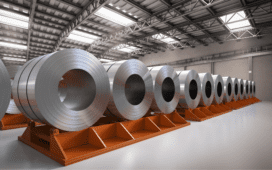

The European Union’s Carbon Border Adjustment Mechanism (CBAM) came into force on January 1, 2026, introducing a carbon levy on imports of emissions-intensive goods entering the EU. The policy covers products such as steel, aluminium, cement, and fertilisers, which form a significant share of India’s exports to Europe. As a result, export costs are expected to rise, potentially complicating market access for Indian manufacturers.

Developing countries, including India, have raised concerns that applying uniform carbon pricing standards does not adequately account for differences in economic capacity and historical emissions, potentially undermining fairness in global trade. For Indian exporters, the transition from a reporting-only phase to one involving real carbon costs and compliance obligations may increase expenses and competitive pressure in the EU market.

Reports indicate that exporters may need to cut prices substantially to absorb these additional costs, while smaller firms could be disproportionately affected by complex emissions measurement, reporting, and verification requirements. The rollout of CBAM has intensified calls for greater global dialogue on climate policy, trade equity, and the need for mitigation and support mechanisms for developing economies.

Reference: Read more